Managing personal money can seem daunting in the fast-paced environment of today. It’s easy to forget where your money is going between keeping track of bills, spending, and future target savings. Now enter the finance management app, a contemporary fix meant to streamline money handling and enable you to seize charge of your financial future.

Here’s why using a finance management app can be the best choice you ever make for your personal budget:

1. Should simplify their financial life:

We are past the days of juggling receipts and spreadsheets. One place for all of your financial data is consolidated by a finance management software. These programs give a clear and complete picture of your financial situation from tracking investments and expenses to monitoring your credit cards and bank accounts.

These kinds of apps usually have automatic algorithms that classify your expenditure, helping you to better know where your money is going. For instance, your app will show you if eating out is sapping your income, so guiding your decisions.

2. Simplified Mobile Payment Alternatives:

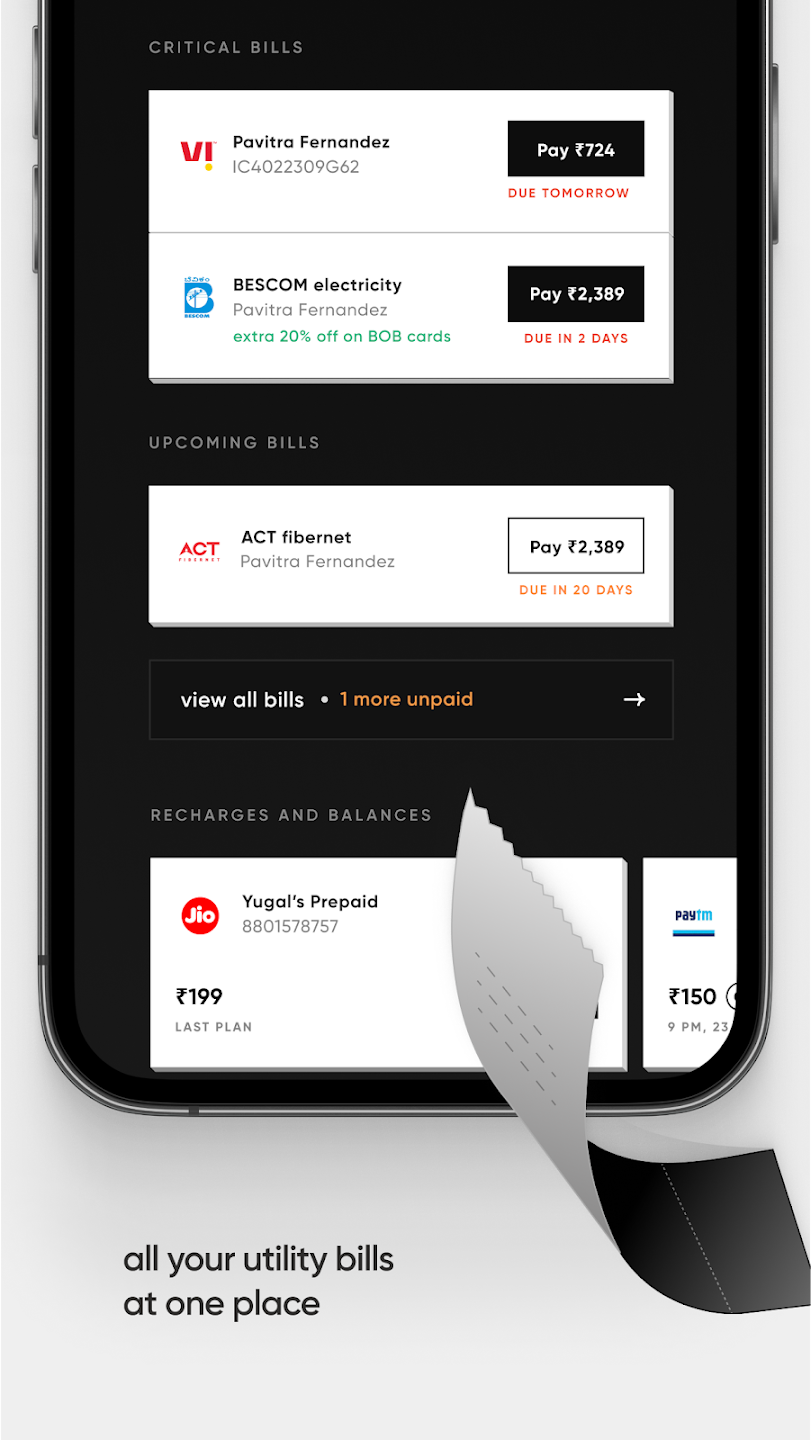

The way a money manager software connects with mobile payment systems is among its most handy aspects. These apps streamline and safeguard all kinds of transactions—from bill payment to fund transfer to online buying.

By using mobile payment choices on your finance app, you also save the trouble of constantly entering card information or carrying cash. Many programs also let you schedule regular bill payments, guaranteeing that you never miss a due date.

3. Improved Income Management and Budgeting:

Though many people find it difficult to design and follow one, budgeting is the pillar of good finances. Analysing your income and expenditure habits helps a finance management tool create a budget that is simple For areas such groceries, entertainment, and transportation, you can establish monthly spending restrictions; the app will notify you should your limit be close.

These programs also enable you to dedicate money for savings projects including a trip, emergency fund, or new house. Seeing your development helps you to keep inspired to follow your agenda.

4. Real-Time Notifications and Insights:

Imagine getting a warning about a low account balance or about a dubious transaction. Real-time notifications sent by a money management app keep you aware of your financial activity.

Certain programs also include spending reports, which let you see trends and pinpoint areas needing work. For instance, you might discover you are paying more for subscriptions than you had assumed, which might cause you to cancel extra services.

5. Stress-Free Financial Management:

Future planning doesn’t have to be intimidating. Through options for retirement savings, debt payments, and investment tracking, a finance management software streamlines long-term financial planning. These applications enable you to act without feeling overwhelmed by dissecting large goals into doable steps.

6. Added Control and Security:

Advanced encryption technologies in modern financial management applications help to guard your information. Many also provide biometric authentication—that is, fingerprint or facial recognition which adds still another degree of protection to your mobile payments and financial activities.

Conclusion:

More than just a tool, a finance management software is your personal money manager, guiding you towards financial freedom and wiser decisions. From streamlining mobile payments to providing analysis of your spending patterns, these apps give the ease and clarity required in the digital era of today.

Investing in the correct software could be the finest choice you make for your personal finances if you are ready to take control of your money management and reach your financial objectives. Start now and see how little adjustments up to great financial advancement!