In the modern financial landscape of India, individuals are increasingly exploring systematic ways to grow their savings. Among the many instruments available, Uti Mutual Fund options have emerged as practical tools for those aiming to accumulate long-term wealth. Whether you’re a first-time investor or someone looking to diversify your portfolio, mutual funds provide a flexible and goal-oriented approach. With the rise of digital platforms, managing investments through an investing app has never been easier or more convenient.

Mutual funds pool resources from various investors and channel them into a diversified basket of assets. These could include equities, fixed-income instruments, and other securities. The primary goal remains consistent—capital appreciation or steady income based on your risk tolerance and financial goals.

Why Choose Uti Mutual Fund for Your Investment Goals?

Choosing the right fund category matters. When selecting a suitable mutual fund, various factors—such as risk appetite, time horizon, and expected returns—need careful evaluation.

Uti Mutual Fund offerings are structured to serve investors with different financial goals. From equity-focused funds that aim for long-term capital gains to hybrid and debt-based funds that offer stability, investors can choose based on individual risk preferences. Furthermore, the presence of professional fund managers ensures efficient handling of the fund’s portfolio.

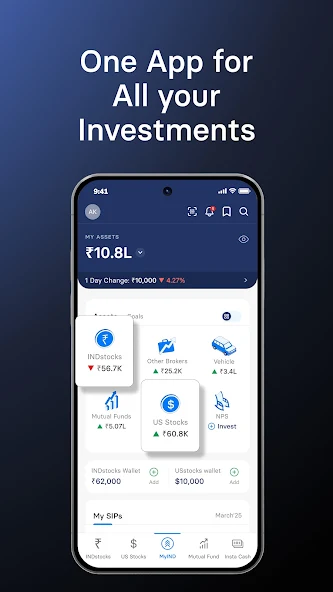

In today’s digital age, access to investment tools via an investing app empowers investors to track performance, switch funds, and make timely decisions—all from the convenience of a mobile device.

Types of Mutual Fund Options for Wealth Creation

Equity-Based Funds

Equity mutual funds primarily invest in shares of companies and are ideal for investors looking at long-term growth. These funds may include large-cap, mid-cap, small-cap, or sectoral allocations based on the fund’s strategy. Though volatile in the short term, they offer higher return potential over extended periods.

Hybrid Funds

Combining equity and debt components, hybrid funds aim to balance growth and risk. These are suitable for moderate-risk investors who want exposure to equities while cushioning against market fluctuations through debt instruments.

Debt Funds

Debt mutual funds invest in government securities, bonds, and money market instruments. They offer relatively stable returns with lower risk, making them ideal for conservative investors or those approaching financial goals in the near term.

Index and Passive Funds

Passive investment options like index funds replicate market indices and involve minimal fund manager intervention. These funds often come with lower expense ratios and provide broad market exposure at a cost-effective rate.

How to Start Investing in Uti Mutual Fund Using an Investing App

Digital platforms have simplified the investment process considerably. Here’s a basic on how to get started:

Step 1 – Choose Your Fund

Use the app’s filter and comparison tools to select a mutual fund aligned with your financial objectives and risk profile. Focus on past performance, fund category, and expense ratio.

Step 2 – Complete KYC

All mutual fund investments require Know Your Customer (KYC) compliance. Upload identification documents through the app, which streamlines this step digitally.

Step 3 – Begin SIP or Lumpsum Investment

You can choose between Systematic Investment Plans (SIPs) or one-time lump sum investments. SIPs help inculcate disciplined investing by spreading investments over time.

Step 4 – Monitor and Rebalance

An investing app allows you to regularly monitor fund performance. Periodic review and rebalancing based on changing market conditions or goals are essential for staying on track.

Benefits of Using a Mutual Fund Approach to Wealth Building

Diversification

Mutual funds invest in a broad range of securities, helping reduce the impact of individual asset volatility on the overall portfolio.

Professional Management

Trained fund managers handle investment decisions, allowing investors to benefit from their expertise in asset allocation and market timing.

Liquidity

Most mutual funds offer high liquidity, meaning units can be redeemed relatively easily, subject to applicable exit loads and NAVs.

Transparency and Regulation

Mutual funds operate under strict regulatory frameworks, ensuring high levels of transparency through regular disclosures and fund fact sheets.

Taxation and Cost Considerations

Before investing, it’s important to understand the tax implications:

- Equity funds held for over a year are subject to long-term capital gains tax after a specific exemption limit.

- Debt funds attract a different tax structure, often depending on the holding period.

- Additionally, mutual funds come with expense ratios, which are annual fees charged by the fund house for managing the fund. Lower ratios can help maximize returns.

Using an investing app enables you to view estimated tax liabilities, compare expense ratios, and make informed decisions accordingly.

Common Mistakes to Avoid While Investing in Mutual Funds

While mutual funds are relatively straightforward, investors should steer clear of common errors:

- Timing the market: Attempting to enter or exit based on short-term trends can hurt returns.

- Ignoring risk profile: Choosing aggressive funds when nearing retirement may not align with financial safety.

- Lack of discipline: Skipping SIP contributions or withdrawing funds early can hamper long-term growth.

- Over-diversification: Investing in too many similar funds can dilute potential returns.

Long-Term Wealth Building Strategy with Uti Mutual Fund

Mutual fund investments work best when aligned with long-term financial goals. Whether planning for retirement, a child’s education, or asset creation, consistent contributions and staying invested through market cycles are key. Over time, compounding benefits begin to show, especially when paired with tax-saving mutual fund categories or growth-oriented funds.

Digital tools like an investing app not only simplify tracking but also help stay invested through market highs and lows, offering automated alerts and smart recommendations based on market data.

Conclusion

In summary, using Uti Mutual Fund options as part of a long-term investment strategy can help build sustainable wealth in India. The availability of funds across asset classes makes it easier to create a portfolio tailored to personal financial goals. Moreover, the emergence of the investing app ecosystem has revolutionized how investors approach wealth creation—offering greater control, transparency, and convenience.

Staying disciplined, making informed choices, and leveraging digital platforms are critical to maximizing mutual fund returns. For anyone aiming to grow their wealth consistently, mutual funds present a practical and accessible solution.