Borrowing can be a tricky proposition in the world of personal finance. Do you need a personal loan? For many people, these financial products are a helpful way to get the money you need to meet your goals. Whether you want to consolidate debt, fund a home renovation, or plan the wedding of your dreams, personal loans often offer an interest rate, payment, and term that are better than many other options. Knowing how personal loans work is the first to borrowing wisely and catching the golden ring.

1. Understand the Basics:

Before you jump headfirst into the personal online loan app scene, it’s really important to understand the basics. Unlike loans such as auto or mortgage loans, which have a set purpose, personal loans are more flexible. They don’t need any collateral. You can use them for just about anything. Typically, with these loans, you borrow a set sum from a lender and agree to pay it back over a specified period, normally in consistent monthly installments.

2. Assess Your Needs:

Before applying for a personal loan, evaluate your financial situation and pinpoint why you need the funds. Whether you need the money to consolidate high-interest debt, cover medical bills, or finance a major purchase, having a clear sense of your borrowing needs can help you select the right loan amount and term.

3. Shop Around for the Best Rates:

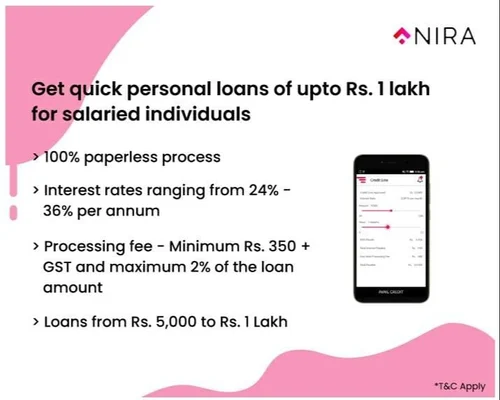

Interest rates can differ a lot from one loan app to the next, so it’s really important to check out and compare offers from several financial places. Don’t just stick to old-school banks – also consider online lenders, credit unions, and even peer-to-peer lending platforms to track down the best rates and terms for your specific money situation.

4. Check Your Credit Score:

Your credit score is pretty crucial when it comes to figuring out what sort of interest rate you’ll be eligible for with a personal loan. Before jumping in and applying, do yourself a favor and peek at your credit report for any mistakes. Having a solid credit score not only enhances your chances of getting approved but also opens up the opportunity for lower interest rates. And, believe me, that can save you a nice chunk of change over the total duration of the loan.

5. Understand the Fees and Terms:

In addition to interest rates, personal loans may come with various fees and terms that can impact the overall cost of borrowing. They can be fixed or variable, impacting your monthly payments and total loan cost. Remember, a lower interest rate isn’t the only factor:

- Origination fees are a one-time upfront charge for processing the loan, normally varying from 1% to 8% of the loan amount.

- Late payment fees: Missing a payment triggers additional fees, often exceeding 5% of the outstanding balance.

- Prepayment penalties: Early repayment could cost you extra cash, so consider these if you’re hoping to pay the loan off ahead of schedule.

6. Create a Repayment Plan:

Create a solid repayment plan before you take out a personal loan so you can make sure you stay on time with your financial obligations. Calculate your monthly payments on your loan so you can see how the loan amount, interest rate, and term length would work into your budget. Working out a budget might help you plan better and, therefore, pay off your loan responsibly.

Personal loans can really come in handy when it comes to meet your financial goals. But it’s crucial to borrow smartly to prevent unwanted debts and financial stress. Don’t forget, always borrow responsibly and stick to debts you know you can easily pay back.