An instant personal loan can create an impact on your credit score in numerous ways – which can be both positive and negative. Getting a personal loan is not bad as it is assumed by many, it can actually boost the credit profile if used effectively. However, it might impact your total credit score on temporary basis and can also make it a bit complicated for you to get extra credit before that new loan taken gets repaid.

Your credit score is estimated based on five main factors – payment record, amounts owed, credit history length, fresh credit taken, and credit blend. The actual percentages differ between the three main credit rating bureaus. Therefore, getting a new cash loan can affect your credit rating, and your total remaining debt gets increased; thus, you have also acquired a new debt.

Also, credit rating agencies take into account any new financial activity undertaken. For instance, if you attempted to apply for a personal loan shortly after taking a personal loan, your application might get rejected since, you already have that amount of debt on your name.

Your total credit history has a greater impact on your credit score when compared to an individual new loan. If you have a long history of handling debt and making payments on time, the effect on your credit score by acquiring a new loan will likely be reduced. The simplest and the best method to keep a loan from decreasing your credit score is by making all your payments well on time and within the terms mentioned in the loan agreement.

A personal loan that you redeem on time can positively impact your overall credit score, since it shows that you can manage debt efficiently and responsibly.

On the contrary, someone who is the most averse when taking debt is concerned can have lousy credit scores as an individual who has not taken any debt to repay it off in the form of installments, and has zero payment history.

The greater your credit score, the more the chances of your loan getting approved and providing you with favorable credit terms, like a lower interest rate. Though various criteria for getting a loan may differ, lenders generally consider scores more than 670 to be good and count a borrower as creditworthy.

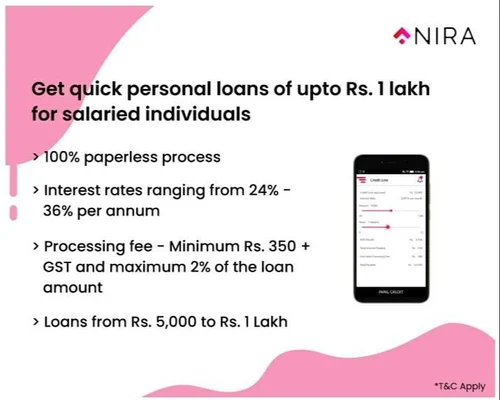

Also, it is important to be noted that while your credit score has an important role to play in letting you qualify for obtaining a personal loan, platforms like NIRA also take into account various other factors such as the amount of money you have in the bank, how much you earn and the duration for which you have been employed.

Getting the correct type of loan can be an especially challenging task in times of a financial crisis, but by having a correct approach, an instant personal loan can still be obtained during adverse times. And a personal loan app can help in it.

Funds procured with the help of a personal loan can be used for various purposes, such as repaying your debts, financing home repairs or renovations, or catering to an unforeseen medical emergency.

Conclusion:

A personal loan may hit a minor low to your credit score in the short run; however, making timely payments will bring it back on track and allow you to enhance your credit score in the long run.